Building a new website for your firm can be an exciting project, but it’s essential to avoid common mistakes that can negatively impact your site’s performance and user experience.

We’ve discovered three main issues when it comes to building wealth management websites.

One of the most common mistakes when building a new website is creating content that is overly wordy and not optimised for different devices, and lengthy paragraphs and dense text can make it difficult for them to quickly find the information they need, leading to frustration and disengagement.

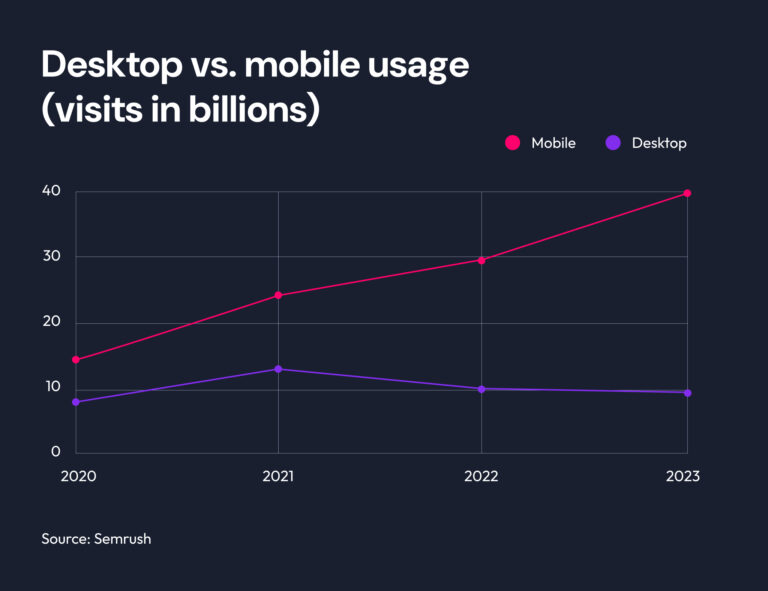

With mobile usage continuing to surpass desktop usage, it is increasingly likely that your clients will engage with your content and learn about your services via their smartphones. With this shift in how users access information, it’s crucial to ensure that your website is optimised for mobile devices, providing a seamless and user-friendly experience that caters to the preferences of today’s digital consumer.

If your website isn’t mobile-friendly or concise, you risk losing potential clients who expect a seamless and efficient user experience.

Our tips:

Olivia Guerra Marketing Manager at WAM Digital

It’s tempting to include every possible feature on your website, from multiple sections and links to several deal pages to competing calls-to-action (CTAs) and overly complex navigation. However, overcomplicating your site can overwhelm visitors and too much clutter can result in choice paralysis.

The same principle applies to websites. If your site is packed with too many options, it becomes harder for visitors to take meaningful action, whether that’s booking a consultation or learning more about your services.

To simplify, ensure your messaging is clear and focused. Highlight your firm’s core offerings and create a streamlined navigation experience and limit CTAs to one or two that align with your key business goals. A straightforward and intuitive website fosters trust and encourages engagement.

While chatbots can be a helpful tool, relying too heavily on automated systems can feel impersonal, especially for clients who value and have come to expect bespoke service like in wealth management. Automated responses may create a barrier, leaving clients feeling disconnected or undervalued.

We’ve seen a rise in chatbots over the last 5 years but more recently a fall as the reality dawns that so few visitors use them particularly in our industry.

Building meaningful connections is crucial in wealth and asset management. Instead of relying solely on chatbots, provide clear and direct contact options, such as a dedicated email address or phone number prominently displayed on your site.

A contact form still plays an important role too, and can be used to segment the nature of the enquiry by offering a dropdown reason, as well as capturing some user data. But don’t ask too many questions: a cumbersome or overly-intrusive form will only result in less submissions.When automated tools are used, ensure they’re supplemented by human interaction whenever possible. Personal touches make a significant difference in fostering client relations.

At WAM Digital, we specialise in designing websites tailored for the wealth and asset management industry. Our team understands the unique needs of audiences and creates websites that are not only visually engaging but also optimised for trust-building and client conversion.

Ready to elevate your online presence?

Let’s discuss how we can help build a website that truly works for your business. Contact us here.